Tag: used car loan

-

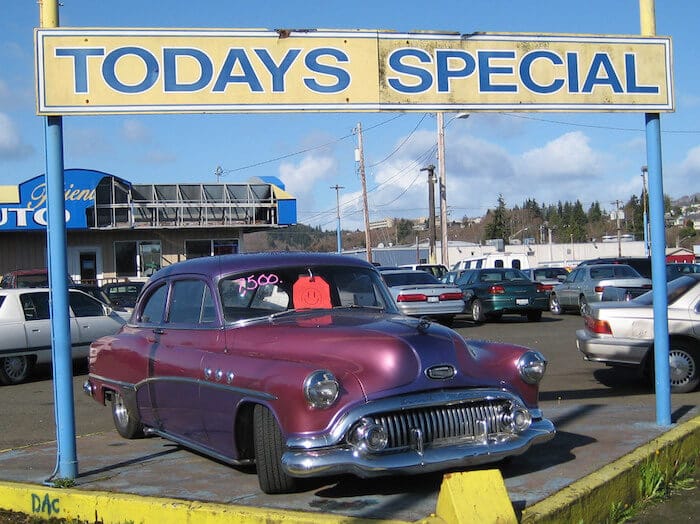

Why Apply for a Used Car Loan- An Informative Guide

Getting a used car loan is more challenging than that for a new one, primarily due to the higher interest rates and the fact that the financer considers a variety of factors before validating the loan. Having a vehicle of your own is an exhilarating experience. However, finding the appropriate car that meets your budget…

-

Looking To Apply For Used Car Loan? Here Is Everything You Need To Know About!

Owning a car isn’t a milestone anymore. Every family, be it small or big, middle or high-class, wants their car. People find buying used cars profitable as well as an affordable solution. Furthermore, now buying a car has become much easier with the help of used car finance or loans. Thanks to the loan criteria,…

-

13 Big Reasons to Buy a Small Car

Did you realize that Mark Zuckerberg’s everyday ride can be an Acura TSX? It is a compact car worth $30,000 that’s approximately half how big a Mercedes S350. Inspite of the prestige that comes with having a big car, additionally it draws unnecessary attention. Are you considering switching to a car with smaller dimensions than…

-

How Many Years Can You Finance a Used Car?

Used cars are ideal because they’re highly affordable and suitable for people planning to own a car for the first time. In fact, you can get a variety of premium brands as well as economical subcompact cars to suit various needs. For most first time buyers, the burning question is: How many years can you…