Author: Catherine Morrow

-

SuperEasy Ways To Find Military Car Loans

Do military get limits on vehicles? Indeed, they do. Practically all significant brands such as Ford and Toyota do this lasting through the year on explicit models. By and large, banks and other standard credit moneylenders offer low-premium military vehicle advances. Would it be a good idea for you to apply for one? We should…

-

Is Getting a Secured Car Loan Hard?

A secured car loan is whereby a consumer pays an advance payment and hands over a resource to be able to obtain financing for their new car. Unlike a normal auto loan where in fact the dealership or credit lender holds a lien, secured auto loans allow creditors to hold on to houses, stocks, and…

-

How to Get a 6 Month Car Lease No Deposit

Do you have to put a deposit down when leasing a car? No, you don’t. However, a $0 down payment car finance is also possible with the right dealership. Buyers usually pay 20-30% of the car’s price upfront with a traditional loan. Which is one reason why you might be considering a lease with a…

-

What Is a Private Party Auto Loan?

Numerous individuals feel more secure doing an individual gathering vehicle deal including a companion or relative. That is on the grounds that you’ve most likely determined the vehicle commonly and perceived how the proprietor looks after it. Besides, this kind of offer has more space for value arrangement in contrast with dealerships. Indeed, you may…

-

30 Essential Items for Your DIY Car Emergency Kit

Winter is less than a month away. As you enjoy the Christmas holiday, you might run into some navigation issues due to the thick snow all around. How do you prepare for these challenges? We encourage you to get a car emergency kit.This kit enables you to make quick repairs and enhances your survival during accidents or…

-

Blank Check Auto Loan: What is it & Do You Need it?

A limitless ticket to ride car credit is when a bank offers you an advance to back an automobile.The bank empowers you to pick either a pristine or trade-in vehicle then they get it. It is an alternate idea from average vehicle financing where either the credit bank or business offers you foreordained vehicles and advance…

-

13 Big Reasons to Buy a Small Car

Did you realize that Mark Zuckerberg’s everyday ride can be an Acura TSX? It is a compact car worth $30,000 that’s approximately half how big a Mercedes S350. Inspite of the prestige that comes with having a big car, additionally it draws unnecessary attention. Are you considering switching to a car with smaller dimensions than…

-

Can You Buy a Car without a License?

Do you’ll need a license to get an automobile? No, you don’t. Actually, you can certainly do it legally at a dealer or a private sale. You can even apply for regular financing for either a new or used vehicle. Tip: How exactly to Get Car Loans for People who have Bad Credit Fast & Secure…

-

How Car Repossession Works

Is vehicle repossession terrible? Indeed, it is fundamentally on the grounds that it influences a purchaser a few different ways. Notable impact is a bother since you understand how open vehicle might actually get bulky. Coming up short on an auto is awful these days, since, how might you’re ready to class or work on…

-

How Many Years Can You Finance a Used Car?

Used cars are ideal because they’re highly affordable and suitable for people planning to own a car for the first time. In fact, you can get a variety of premium brands as well as economical subcompact cars to suit various needs. For most first time buyers, the burning question is: How many years can you…

-

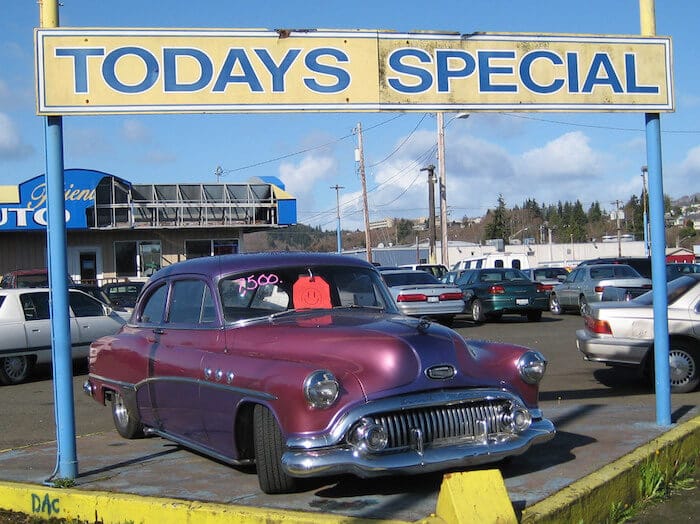

What to Know When Buying a Car out of State

Imagine returning home from a business trip in a different state and you happen to pass by a dealership with excellent cars. You decide to step in and the prices are so affordable that you can’t fight the urge to buy your dream SUV. Can you buy a car in another state? Yes, it’s legal.…

-

What is a Lien on a Car?

Are you currently about to get a car but the dog owner told you so it includes a lien? It’s a right that the us government gives to a creditor to assume ownership of a debtor’s collateral asset. In short, the us government gives your bank or credit lender permission to repossess your car once…

-

Cars, Trucks, & SUV’s that Last the Longest

If you’re planning to spend a lot more than $30,000 on a new car, then you expect to have value for money. The automobile must have excellent driving and safety features to improve its long-term durability. One feature common in the longest lasting cars is some accident prevention features. Why is durability crucial that you…

-

Save Money! Keep Your Tire Tread Wear Patterns Even

If you’re preparing to buy a used car for the first time, you need to learn how to identify tire tread wear patterns. This knowledge helps you get value for money because you can get a lower price by knowing what to look for. You also need this information if you’re planning to buy a…

-

How to Plug a Car Tire (The Easy Newbie Guide)

Have you basically seen a sluggish hole in your vehicle or truck tire yet can’t fix it since you don’t have an extra in your trunk? Maybe you saw this predicament while heading to a critical conference and you can’t hazard getting late by heading to a tire look for a substitution. Notwithstanding, in the…